Powering Reliable, Explainable Data for Credit Decisioning at iwoca with Chalk

Client

Use Case

Industry

Cloud

Challenges

- Fragmented feature logic between training and production pipelines

- Overnight ETL jobs that that eroded trust in recent data

- Timestamp drift affecting credit scores and auditability

Solutions

- Unified resolver graph for consistent feature definitions across training and production

- Point-in-time recomputation from source-of-truth data

- Compute-first architecture with full versioning and auditability

Overview

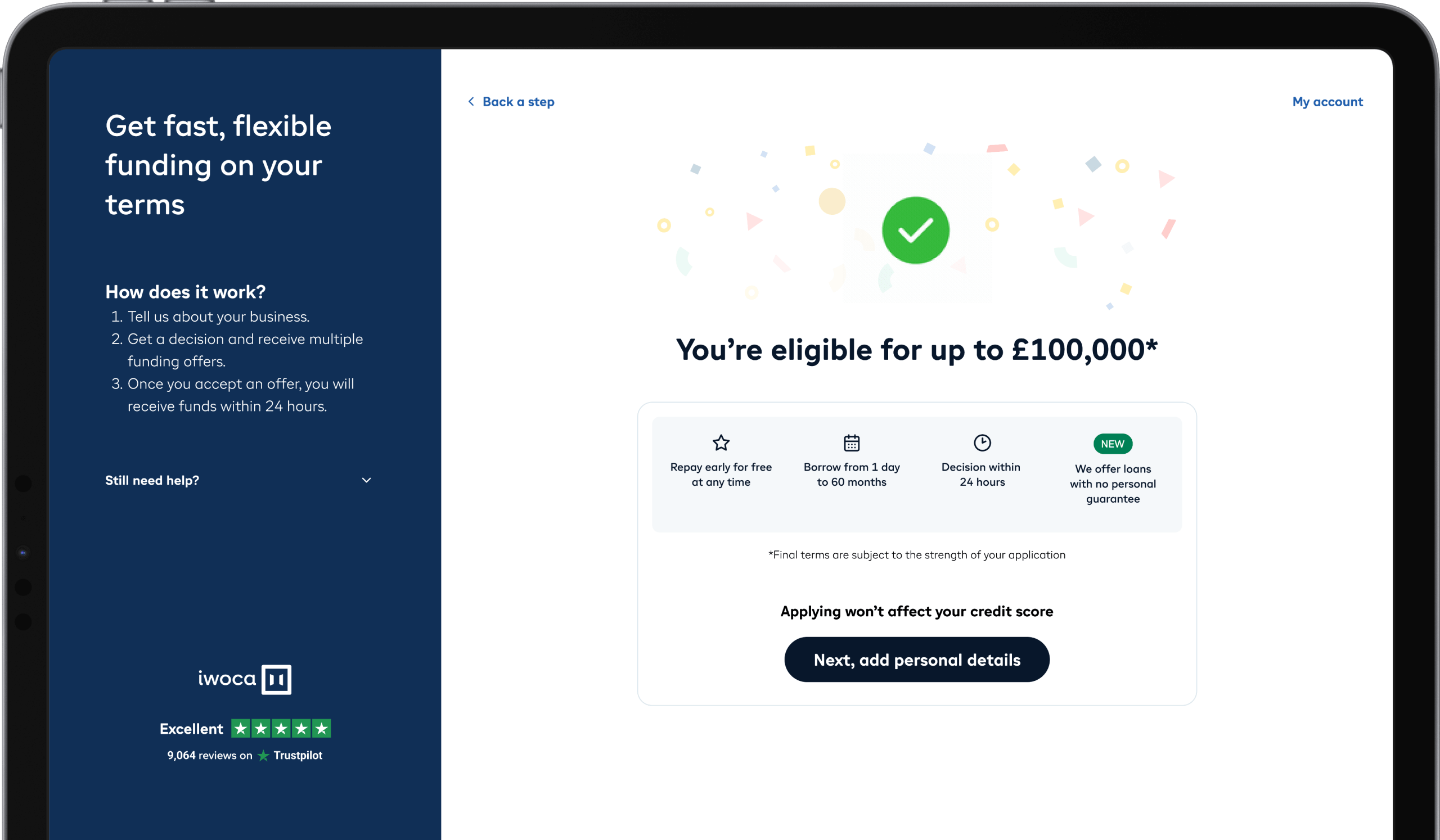

When a business seeks a loan, iwoca’s credit models ingest hundreds of features per application and produce credit decisions of up to £1,000,000 within seconds. There is no room for error; wrong inputs lead to wrong outputs or process failures. With hundreds of thousands of loan offers generated each year, a stable base for serving data is critical.

For iwoca, accuracy and reliability are paramount. As one of Europe’s leading SME lenders, the company provides flexible financing to thousands of small and medium-sized businesses. Each decision must be consistent, defensible, and explainable.

Data science is central to iwoca’s operations, their models underpin responsible lending and ensure every offer is based on precise and transparent data. Over time, complex ETL pipelines made maintaining that precision and generating training sets slower and more difficult to observe.

The Challenge

After more than a decade of growth, iwoca’s feature pipelines had become fragmented. Training and production definitions diverged. Overnight ETL jobs were slow and unreliable, and teams spent more time managing pipelines and reconciling data drift than improving models.

The problem was not data scale but data integrity. iwoca’s data is precise and time-dependent, combining bureau data, transaction records, and evolving cash-flow signals. Even a small timestamp error could change a credit score or repayment forecast.

When assessing platforms like Tecton and Michelangelo, iwoca found they were designed for high-throughput workloads such as personalization. Chalk provided the same scalability with the temporal precision, traceability, and auditability required for financial modeling.

The Solution

iwoca chose Chalk for its architecture, which aligned with the team’s engineering philosophy. Unlike traditional feature stores, Chalk computes features directly from source data and can persist them in online or offline stores when needed, but it does not rely on those stores as the source of truth.

This architecture gives iwoca deterministic control over every feature. Features can be recomputed for any historical point in time from the source-of-truth data, ensuring accuracy without duplication or manual backfills.

With Chalk, iwoca:

- Generates point-in-time-correct training datasets using the same definitions as production

- Recomputes features on demand for any historical period

- Reduces drift between training and serving by keeping feature definitions aligned

- Versions every dataset for complete traceability

The result is a single system where consistency starts with training. Models trained on Chalk reflect exactly what was known at the time of decision, ensuring alignment between training and live prediction.

Architecture

Traditional feature stores store precomputed features for offline and online systems, requiring constant synchronization. This ETL-driven approach causes drift, duplication, and uncertainty about which version of a feature is correct.

Chalk’s feature engine reverses the ETL model by treating computation as the primary mechanism and storage as an optimization. Traditional systems treat stored features as the source of truth, while Chalk uses raw data as the authoritative source, resolving features through dependency graphs and recomputing them as needed.

Legacy Architecture

Chalk Feature Engine

- Manually maintained offline store prone to missed or delayed updates

- Features recomputed directly from source

- Separate pipelines for training and serving

- Unified resolver graph governs both

- Manual backfills and sync tasks

- Deterministic recomputation for any time point

- Offline store as source of truth

- Raw data as source of truth

For iwoca, this model prevents inconsistencies that could alter credit outcomes and scales more reliably than synchronization-based systems.

By making computation the source of truth, Chalk gives iwoca a credit platform where data integrity is not maintained through process, but guaranteed by design.

Outcomes

By rebuilding on Chalk, iwoca turned accuracy and explainability into system-level capabilities rather than operational goals.

Metric

Before Chalk

After Chalk

- Training data regeneration time

- 24 hours

- Under 60 minutes

- Feature definitions

- Separate for training and production

- Unified resolver graph

- Offline store

- Required for every model

- Optional cache only

- Data backfills

- Manual and error-prone

- Deterministic, recomputed on demand

- Confidence in inference-time features

- Dependent on ETL consistency

- Guaranteed by architecture

Today, iwoca’s credit decisioning runs on Chalk. Each loan, whether for a bakery, a manufacturer, or a seasonal retailer, is evaluated using features computed from the most current data available. The result is responsible, explainable lending at the pace of business.

Looking Ahead

Fintech and financial-services companies face the same challenge iwoca solved: unifying model training and serving in environments where correctness and consistency can outweigh raw speed.

iwoca plans to expand Chalk’s use across credit decisioning, lifetime-value forecasting, and other areas of iwoca’s business.